The Numbers Don't Lie

Cisco's Q1 earnings reveal the gap between transformation vision and current reality: $1.3B in AI infrastructure orders validates Silicon One, but Security revenue down 2% and AgenticOps absent from discussion. We're at a checkpoint—three months before Amsterdam shows what's actually ready.

(But They Don't Tell the Whole Story Either)

_A checkpoint on Cisco's transformation journey, three months before Cisco Live Amsterdam

Cisco dropped their Q1 FY2026 earnings yesterday, and if you've been following along with this "Building Toward Amsterdam" series, you're probably wondering the same thing I am: how much of the transformation story we've been building is actually happening right now, versus how much is still beautifully rendered roadmap?

The answer, as usual with enterprise technology, is complicated and interesting.

Let me walk you through what I'm seeing in these numbers, because there's a real story here about timing, momentum, and the messy reality of transforming a $60 billion networking giant into an AI-era platform company. This isn't going to be a line-by-line earnings breakdown—plenty of financial analysts will do that. Instead, I want to look at what these numbers tell us about where Cisco actually is on the transformation journey we've been mapping out.

The Headline: Growth Is Real

First, the basics matter. Cisco posted $14.9 billion in revenue, up 8% year-over-year. That's actual growth from a company this size, not just rounding errors or accounting gymnastics. More importantly, they beat their own guidance on both top and bottom lines, with non-GAAP EPS of $1.00 (up 10% year-over-year) coming in above the high end of their range.

For a company that spent years in the "slowly declining legacy networking business" narrative, this is notable. The networking industry isn't supposed to be growing at 8% anymore. The smart money moved on to cloud and SaaS and whatever comes after AI. Except here's Cisco, posting its fifth consecutive quarter of double-digit networking product order growth.

So something is happening. The question is: what, exactly?

The AI Infrastructure Story: Actually Shipping

Here's where it gets interesting for my purposes. Cisco called out $1.3 billion in AI infrastructure orders from hyperscalers this quarter. That's not a typo. $1.3 billion. And they explicitly described this as "a significant acceleration in growth."

Remember the Silicon One conversation? The bet that Cisco could compete in AI networking not by building the most technically elegant solution, but by building something good enough that plugged into the infrastructure enterprises and hyperscalers were already running? That bet is paying off right now, in real dollars, in Q1 FY2026.

This matters because it validates the foundational layer of the transformation thesis. If Silicon One wasn't winning AI networking deals, everything else we've been discussing—Hypershield's distributed security, Splunk's unified observability, AgenticOps autonomous agents—would be building on quicksand. You can't layer AI-powered security and operations on top of network infrastructure you're not actually selling.

But Cisco is selling it. To hyperscalers. At scale. That's the ball game right there.

The Campus Refresh: The Other Growth Engine

The second big revenue driver is something Cisco's calling a "multi-year, multi-billion-dollar campus networking refresh cycle." Every campus technology—switching, routing, wireless, IoT—saw accelerated order growth in Q1. And crucially, Cisco notes that their next-generation solutions (smart switches, secure routers, WiFi 7 products) are "ramping faster than prior product launches."

This is where the transformation story intersects with the replacement cycle reality of enterprise IT. Companies are buying new networking gear because, well, the old stuff is old. But what they're buying is materially different from what they bought last time. These aren't just faster switches—they're switches that can participate in distributed security architectures, that can feed data to unified observability platforms, that can eventually be managed by AI agents.

The campus refresh is the Trojan horse for the transformation. Enterprises think they're just upgrading their network. Cisco is positioning them for a completely different operational model.

Whether enterprises actually adopt that operational model is a different question. But at least they're buying the hardware that makes it possible.

The Gaps in the Story

Now let's talk about what's not in these earnings, because that's just as revealing as what is.

Security revenue is down 2%. Not catastrophically down, not collapsing, just... down. This is odd given everything Cisco has said about Hypershield, Security Cloud, and the unified security platform strategy. Observability (which includes Splunk) grew 6%, which is respectable but not explosive. If the thesis is that Cisco's moving from selling point products to selling unified platforms, you'd expect the platform categories to be growing faster than traditional networking.

They're not. At least not yet.

Services revenue grew just 2%. This is the canary in the coal mine for platform transformation. If customers were really buying into the unified control plane story, if they were really adopting AI-powered autonomous operations, services revenue should be growing faster than product revenue. Instead, it's growing slower. Way slower.

This suggests one of two things: either the transformation is still very early (enterprises are buying the products but not yet adopting the operational models), or the services attach rate for the new platforms isn't what Cisco hoped it would be. My money is on "still very early," but it's worth watching.

AgenticOps is completely absent from the earnings discussion. Zero mentions of AI agents, autonomous operations, or any of the "AI layered on top of unified data and control" story we've been building. Not in the press release, not in the prepared remarks preview, nowhere. This isn't surprising—AgenticOps is clearly future roadmap, not current quarter revenue—but it's worth acknowledging the gap between the vision Cisco's pitching and what they're actually selling today.

What the Financials Tell Us About Timing

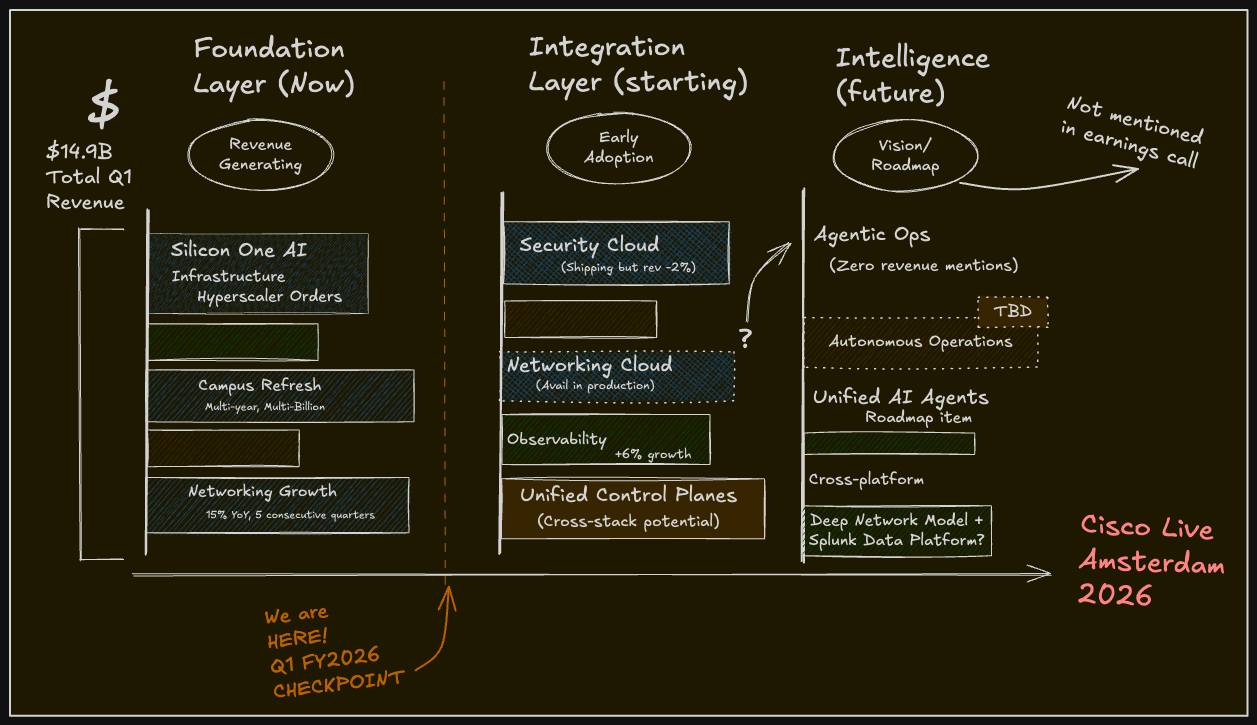

Here's what I think is actually happening, based on these numbers and the broader context we've been building throughout this series:

Phase 1 (Now): Cisco is winning AI infrastructure deals with hyperscalers and executing a massive enterprise campus refresh. Both of these are generating real revenue growth and validating that Cisco's core networking position remains strong. This is the foundation.

Phase 2 (Starting): Cisco is beginning to integrate Splunk's observability capabilities with its networking and security products. Security Cloud and Networking Cloud exist as shipping products, not just marketing concepts. But adoption is early, and customers are still mostly buying point solutions with platform potential rather than fully unified platforms.

Phase 3 (Future): Cisco layers AI agents on top of unified data and control planes, enabling truly autonomous network and security operations. This is where Hypershield's distributed architecture, Splunk's data platform, and the deep network model all come together into something genuinely new.

These earnings are Phase 1 evidence with Phase 2 beginnings. Phase 3 is still aspirational.

The Margin Pressure Question

One more thing worth discussing: Cisco’s gross margins compressed this quarter. Non-GAAP gross margin fell from 69.3% to 68.1%, with product margins down from 68.9% to 67.2%.

Cisco’s press release doesn’t attribute this quarter’s change to tariffs—it only notes that future guidance includes estimated tariff impacts under current trade policy. My read: the Q1 compression probably reflects sales mix and investment, not policy.

When you sell a lot of AI infrastructure to hyperscalers, you’re playing in a market where Google, Amazon, and Microsoft have real negotiating leverage. These aren’t small enterprises buying off a price list—they’re massive customers who can credibly threaten to build their own networking gear if you don’t sharpen your pencil. Lower margins might just be the cost of winning in AI infrastructure.

Alternatively, the margin pressure could reflect Cisco investing in its transformation—integrating platforms, scaling AI capabilities, and accelerating product transitions. Either way, it’s something to watch. The bull case assumes Cisco can sustain healthy margins while shifting from products to platforms; if compression persists, that assumption will need to be revisited.

The Backlog Story: Momentum Continues

Here's the optimistic counter-point to everything above: Cisco's remaining performance obligations (RPO)—basically, their backlog of contracted future revenue—grew 7% to $42.9 billion. Product RPO grew 10%, with long-term product RPO up 13%.

This is future revenue visibility. It means customers are signing multi-year contracts for Cisco gear, which suggests they're not planning to rip-and-replace anytime soon. In an industry where the conventional wisdom is that networking is getting commoditized and cloud-native alternatives are eating traditional vendors' lunch, Cisco keeps signing bigger and longer deals.

That doesn't happen if customers think you're selling yesterday's technology. It happens if customers believe you're going to be relevant for their tomorrow.

What This Means for Amsterdam

So here's where we are, three months before Cisco Live EMEA in Amsterdam: the transformation is real, it's generating revenue, and the foundational pieces are in place. Silicon One is winning AI networking deals. Campus refresh is accelerating. The Splunk integration is progressing. The financial engine is healthy.

But the unified platform story—the vision of collapsed silos, unified control planes, and AI-layered intelligence that we've been building throughout this series—is still mostly potential rather than reality. It's not that Cisco isn't executing. It's that this kind of transformation takes time, and Q1 FY2026 is still early days.

What I'll be watching for at Cisco Live Amsterdam:

Hypershield adoption metrics. Not "we launched Hypershield and customers are excited," but "here are the production deployments, here's what they're protecting, here's how it's performing." If Cisco can't point to real customer implementations by February, the distributed security story is still conceptual.

AgenticOps demos with actual customer data. Show me the AI agents operating autonomously on a real network with real problems. Show me the before-and-after on operational efficiency. Make it concrete and measurable, not just demo-ware.

Cross-platform integration examples. I want to see a customer who's using Security Cloud AND Networking Cloud AND feeding everything through Splunk in a genuinely unified way. Not separate products that theoretically could integrate, but actually integrated in production.

Services attach rate trend. Is the services number still growing at 2%? Has it accelerated? This will tell us if customers are buying the operational transformation along with the products.

The bull case for Cisco's transformation remains intact. These earnings don't contradict anything we've been building throughout this series. But they do clarify the timeline: we're still in the early innings of this game. The pieces are on the board, the strategy is clear, but the outcome is far from determined.

Your Take?

I've been building the bull case for Cisco's transformation throughout this series, and these earnings don't change my fundamental thesis. But they do add nuance to the timing question. We're three months from Amsterdam and still waiting for proof points on unified platforms, AI agents, and truly autonomous operations.

Am I being too impatient? Should we expect Phase 3 capabilities this early? Or is the gap between vision and execution larger than Cisco wants to acknowledge?

What are you seeing in these numbers that I'm missing?

This post is part of the "Building Toward Amsterdam" series, examining Cisco's strategic transformation ahead of Cisco Live EMEA 2026. Previous posts have covered Silicon One's AI networking strategy, Hypershield's distributed security architecture, Splunk integration, AgenticOps and AI Canvas, Security Cloud Control & Identity, and Networking Cloud. The series builds an explicit bull case for Cisco's transformation while maintaining intellectual honesty about what could prove the thesis wrong.