Silicon One: Why Cisco's Ethernet Bet Might Be the Smartest Play Nobody's Talking About

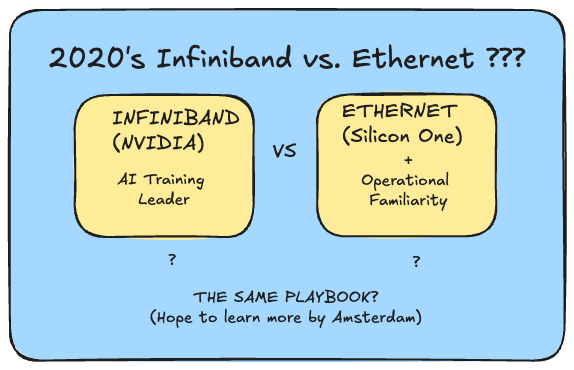

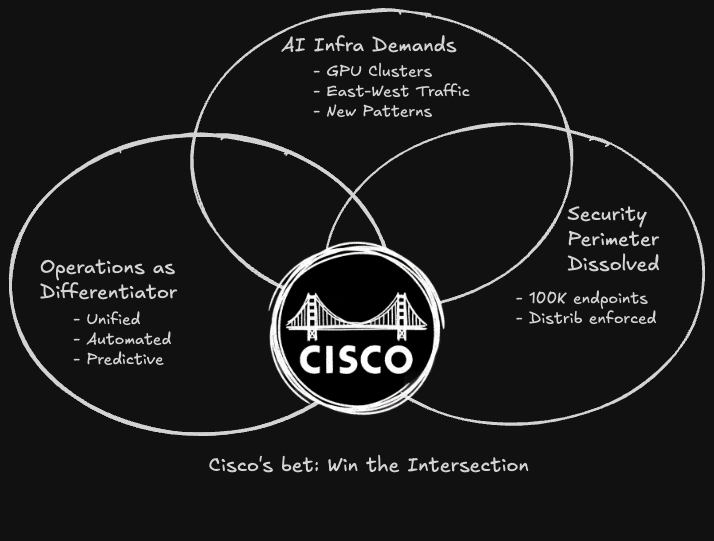

Cisco's Silicon One follows a proven playbook: make Ethernet "good enough," win on operational simplicity. InfiniBand leads AI training, but if workloads fragment toward inference/edge, Cisco's positioned for the larger market. Amsterdam 2026 will show if the pattern holds.

Deep dive #1: How Cisco's building the future they want—and why they've won this exact game before

Link to previous in series:

Let me start with the contrarian take: I think Cisco's Silicon One strategy for AI networking is smarter than the market realizes. And I'm willing to stake my credibility on it.

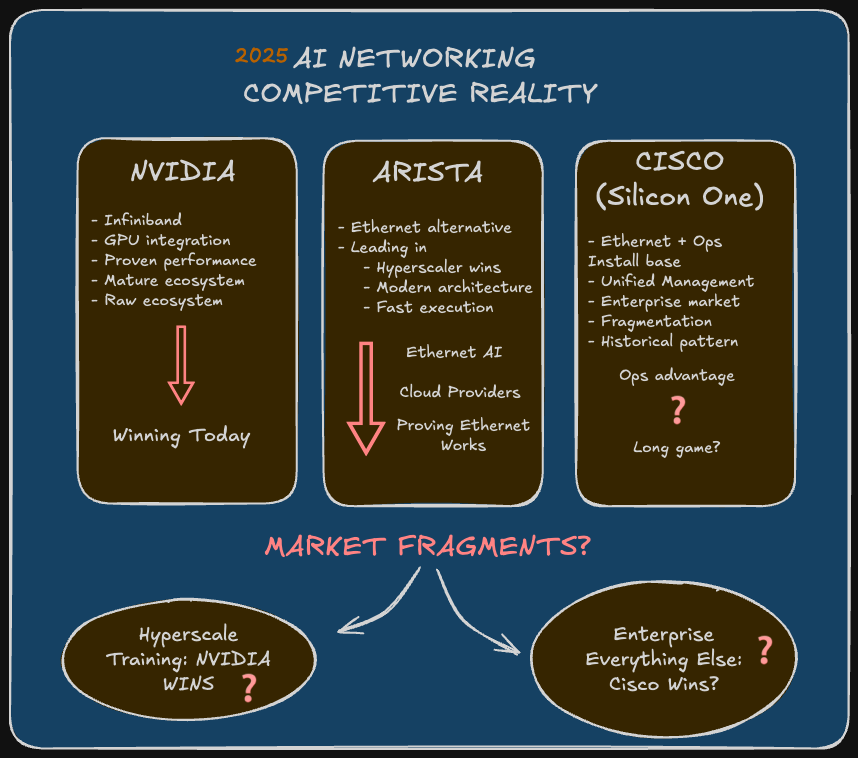

Most analysts see NVIDIA dominating AI networking with InfiniBand. They see Arista winning mindshare with hyperscalers. They see Cisco playing catch-up with Ethernet-based solutions that are "good enough" at best.

I see something different. I see Cisco executing a playbook they've run successfully three times before—and winning not by waiting for the market to validate their bet, but by actively building the future they want.

But I could be wrong. So let me show you the bull case, the evidence that supports it, the historical precedent that makes it credible, and exactly what would prove me wrong.

And here's the thing: while I was writing this analysis, Cisco just delivered evidence that the bull case might be right. On October 8th, they announced the Silicon One P200 chip and the 8223 routing system—already shipping to hyperscalers, with Microsoft publicly endorsing it. The timing is almost too perfect.

The Setup: InfiniBand is "Winning"

Let's be honest about where things stand today.

NVIDIA's InfiniBand networking revenue is growing faster than Cisco's AI networking business. The performance benchmarks favor InfiniBand for large-scale AI training workloads—lower latency, higher throughput, better RDMA support. Meta, Microsoft, and other hyperscalers are deploying InfiniBand at massive scale for their AI clusters.

From the outside, it looks like Cisco missed the AI networking wave. They're pushing Ethernet solutions while the market is standardizing on InfiniBand. Classic Cisco—showing up late with yesterday's technology dressed up in new marketing.

That's the narrative. And on the surface, it's supported by the numbers.

But here's what bothers me about that story: Cisco has been in this exact position before. Multiple times. And they won every single time—not by accepting the market's direction, but by investing relentlessly to make their preferred architecture the winner.

The Pattern: Cisco Doesn't Bet, They Build

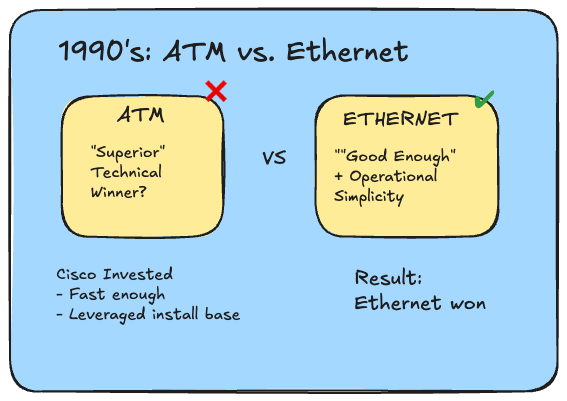

ATM vs. Ethernet (1990s)

ATM was clearly superior. Guaranteed quality of service, circuit-switching advantages, full telco industry backing. The technical community consensus was that ATM would dominate enterprise networking.

Cisco didn't just "bet" on Ethernet. They invested billions in making Ethernet fast enough, reliable enough, and feature-rich enough to compete. They built switching ASICs that could scale Ethernet performance. They developed protocols that added QoS capabilities. They created product lines that made Ethernet deployments operationally simple.

Ethernet won not because it was technically superior—it wasn't. It won because Cisco made it "good enough" while preserving the operational simplicity and cost advantages that mattered to actual customers.

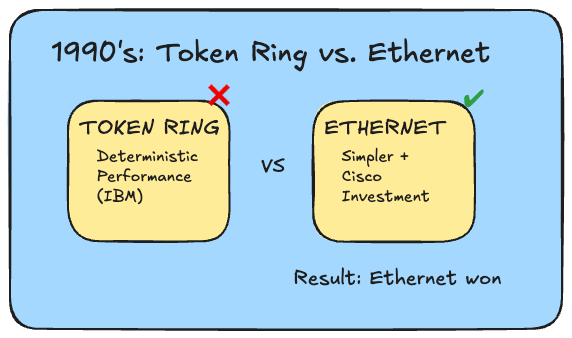

Token Ring vs. Ethernet

Same story. IBM's Token Ring had deterministic performance characteristics that Ethernet couldn't match. For applications requiring predictable network behavior, Token Ring was the "right" choice.

Cisco pushed Ethernet relentlessly. They improved collision detection, increased speeds, added switching to eliminate collision domains entirely. They didn't wait for Token Ring to fail—they made Ethernet good enough that Token Ring's advantages stopped mattering.

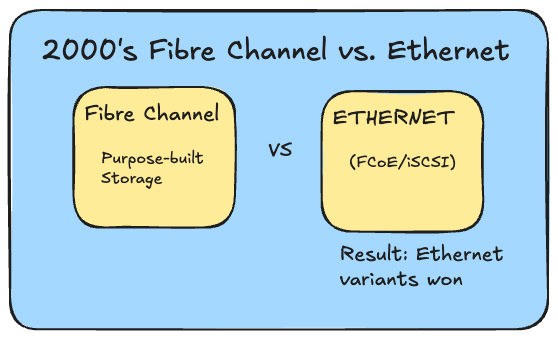

Fibre Channel vs. Ethernet for Storage

Fibre Channel was purpose-built for storage networking. Lower latency, lossless transmission, proven reliability. The storage industry was standardized on it.

Cisco pushed Converged Enhanced Ethernet and FCoE. While FCoE itself didn't fully win, the pattern held: Ethernet-based storage alternatives (iSCSI, NVMe over TCP, eventually NVMe-oF) gradually displaced Fibre Channel in most environments. The operational simplicity of unified networking beat the technical advantages of purpose-built storage networks.

The Pattern is Clear

Cisco doesn't bet on Ethernet becoming good enough and wait for the outcome. They invest in making Ethernet good enough—in silicon, in protocols, in operational tooling—while competitors are building technically superior alternatives that are operationally more complex.

Then they leverage the installed base, the operational familiarity, and the unified management story to win the long game.

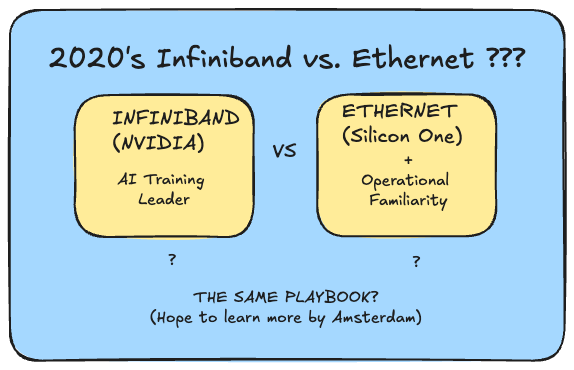

This is exactly what they're doing with Silicon One and AI networking.

The question isn't whether Cisco is betting on Ethernet over InfiniBand. The question is whether they can execute the playbook one more time—and whether the AI networking market follows the same pattern as previous infrastructure transitions.

The Bull Case: Why Silicon One Might Win

Here's the optimistic scenario for how Cisco's Silicon One strategy plays out over the next 3-5 years.

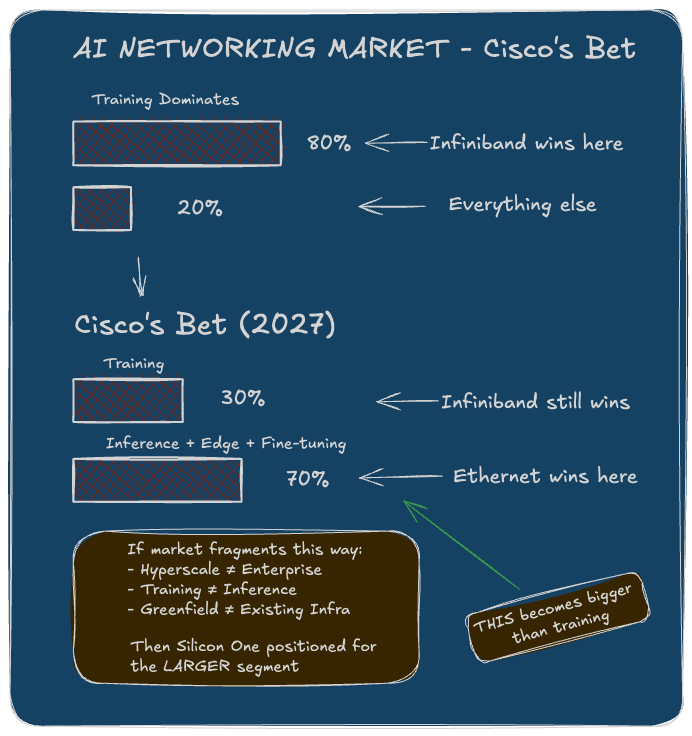

1. AI Workloads Are Fragmenting

Right now, the conversation is dominated by large-scale training clusters. GPT-4, Llama, other frontier models—these require massive GPU clusters with ultra-high-bandwidth, low-latency interconnects. InfiniBand excels here.

But that's not where most enterprise AI infrastructure is heading.

Inference workloads have different requirements—more distributed, lower per-request bandwidth, higher emphasis on operational flexibility. Fine-tuning smaller models for specific use cases doesn't need InfiniBand-level performance. Edge AI deployments require standard networking that integrates with existing infrastructure.

Cisco's bet: The AI networking market fragments into "hyperscale training" (where InfiniBand might continue to win) and "everything else" (where Ethernet's operational advantages matter more). The "everything else" category becomes bigger than training over time.

If this is right, Silicon One is positioned for the larger market.

2. Ethernet is Closing the Performance Gap

The Ultra Ethernet Consortium—which Cisco is heavily involved in—is working on specifications that address InfiniBand's key advantages: RDMA over Ethernet improvements, congestion control, low-latency guarantees.

Silicon One's architecture is built to implement these standards. Programmable pipelines, deep buffers, advanced telemetry—it's designed for adaptability as Ethernet standards evolve.

Cisco's not waiting for Ethernet to organically improve. They're investing engineering resources in the consortium, building silicon that can implement new standards quickly, and working with customers on early deployments that prove Ethernet can handle AI workloads.

This is the ATM playbook: make Ethernet fast enough, then leverage operational advantages.

3. Operational Simplicity Beats Technical Purity

Here's what I keep hearing from enterprise customers: "We have teams that know Ethernet. We have monitoring tools for Ethernet. We have decades of runbooks for Ethernet troubleshooting. InfiniBand requires new skills, new tools, new operational models."

For hyperscalers building greenfield AI infrastructure, that doesn't matter. They'll hire InfiniBand specialists.

For enterprises adding AI capabilities to existing infrastructure? The operational friction is real.

Cisco's building on this advantage: Security Cloud Control and Networking Cloud are designed to manage AI networking infrastructure with the same tools customers use for the rest of their network. ThousandEyes integration means visibility into AI traffic with familiar interfaces. Splunk integration means AI network telemetry feeds into the same observability platform as everything else.

This is the unified operational story. It's not just about Silicon One's technical capabilities—it's about making AI networking feel like networking, not like a specialty deployment requiring different teams and tools.

4. The Installed Base Creates Gravitational Pull

Cisco owns the enterprise networking installed base. When customers build AI infrastructure, they're not replacing their entire network—they're extending it.

Silicon One slots into existing Catalyst architectures. It interoperates with existing management platforms. It uses familiar configuration models.

Cisco's leveraging this ruthlessly: The path from "standard enterprise network" to "AI-ready network" is evolutionarily smooth with Silicon One. The path to InfiniBand requires ripping out infrastructure and starting over.

For incremental AI deployments—which is what most enterprises are actually doing—evolution beats revolution.

What Cisco Is Actually Building

Let's get specific about the technical architecture, because this isn't vaporware. Cisco's investing real engineering resources in making this vision concrete.

Link: Cisco Silicon One Product Family White Paper

The 8000 Series Platforms

Silicon One ships in actual products—the Cisco 8000 series routers and distributed switches. These aren't lab prototypes; they're deployable hardware.

The brand-new 8223 routing system (announced October 8th, already shipping to hyperscalers) is the industry's first 51.2 Tbps fixed Ethernet router. It features 64 ports of 800G connectivity, processes over 20 billion packets per second, and fits in a compact 3-rack-unit form factor. Critically, it supports 800G coherent optics enabling connections up to 1,000 kilometers—purpose-built for distributed AI clusters.

8800 distributed switches handle the high-radix, low-latency requirements for AI cluster interconnects. They're competing directly with NVIDIA's Quantum-2 InfiniBand switches.

8100 and 8200 series address the spine-leaf architectures that connect AI clusters to the rest of the data center infrastructure.

The product line is real. And now we have evidence that customers are deploying it at scale.

Software Integration

Here's where Cisco's broader transformation story connects to Silicon One:

Networking Cloud provides unified management across Catalyst and Silicon One platforms. One operational model, one set of tools, whether you're managing campus access switches or AI cluster networking.

ThousandEyes integration gives path visibility into AI traffic flows—understanding where bottlenecks occur, how traffic traverses the network, where latency is introduced.

Splunk integration means AI networking telemetry flows into the same observability platform as application performance data, security events, and infrastructure metrics. Correlating network behavior with AI model performance becomes operationally feasible.

This isn't just about selling switches. It's about making AI networking manageable with tools customers already have.

Where NVIDIA and Arista Are Stronger

Let me be clear about where the competition is winning right now, because the bull case only works if I'm honest about Cisco's weaknesses.

NVIDIA's Integrated Advantage

NVIDIA sells GPUs and networking together. When you're deploying an AI training cluster, buying everything from NVIDIA simplifies procurement, ensures compatibility, and provides single-vendor support.

Current reality: For hyperscale training clusters, NVIDIA's integrated approach is winning. The performance is proven, the deployment model is straightforward, and the ecosystem is mature.

Bull case response: This advantage matters most for greenfield AI-first deployments. It matters less for enterprises extending existing infrastructure. And if AI workloads fragment toward inference and edge deployments, the integrated GPU+networking story becomes less compelling—you're not always deploying at the scale where InfiniBand's advantages matter.

But NVIDIA's lead is real. Cisco's not winning the hyperscale training market today.

Arista's Hyperscaler Relationships

Arista has deeper relationships with Meta, Microsoft, and other cloud providers for AI networking deployments. They've won design wins, proven their architecture at scale, and built operational credibility.

Current reality: Arista's revenue growth in AI networking is impressive. They're positioned as the "Ethernet alternative to InfiniBand" and they're executing well.

Bull case response: Arista's strength is in the hyperscaler segment. Cisco's advantage is in the enterprise. If the market fragments—hyperscalers build one way, enterprises build differently—then Arista winning cloud provider deployments doesn't prevent Cisco from winning enterprise deployments.

But Arista's proving that Ethernet CAN work for AI networking, which validates part of Cisco's thesis while also taking market share Cisco expected to own.

Technical Performance Gap

Let's be specific: InfiniBand has measurably better performance for certain AI training workloads. Lower latency, higher effective throughput, better RDMA support.

Current reality: For collective operations in large-scale training (AllReduce, etc.), InfiniBand is faster. The benchmarks are clear.

Bull case response: The performance gap narrows as Ethernet standards evolve and as Silicon One's architecture improves. More importantly, the "everything else" category of AI workloads doesn't need InfiniBand-level performance. Inference, fine-tuning, smaller-scale deployments—Ethernet is already "good enough."

But if the performance gap doesn't narrow, or if "good enough" Ethernet isn't actually good enough for most enterprise AI workloads, the bull case falls apart.

Early Evidence: The October 8th Announcement

While I was writing this analysis, Cisco provided significant validation for the bull case.

On October 8th, they announced the Silicon One P200 chip and the 8223 routing system. Here's what matters:

It's shipping now. Not a roadmap, not a prototype—the 8223 is shipping to initial hyperscalers as of October 2025. This validates the "customer adoption" criterion I was planning to watch for in early 2026.

Hyperscaler endorsement is real. Microsoft's Dave Maltz publicly stated that as an early Silicon One adopter, "the common ASIC architecture has made it easier for us to expand from our initial use cases to multiple roles in DC, WAN, and AI/ML environments." This is exactly the operational simplicity story resonating with a major customer.

The "scale-across" positioning is clear. Cisco's not claiming to beat InfiniBand for massive training clusters. They're targeting the problem of connecting AI workloads across multiple data centers separated by hundreds of miles. This aligns perfectly with the market fragmentation thesis—they're defining a category where Ethernet's advantages matter.

The specs are real. 51.2 Tbps, 64 ports of 800G, 65% power reduction, deep buffering for AI traffic patterns. These aren't incremental improvements—they're addressing the actual constraints (power, space, operational complexity) that enterprises face.

Open-source first. The 8223 ships with SONiC support initially, IOS XR later. Cisco's prioritizing hyperscaler preferences over their traditional operating system. They're serious about competing beyond their comfort zone.

This doesn't prove the bull case is right. But it validates that Cisco is executing on the playbook faster than I expected, and early customers are responding positively.

What Would Prove Me Wrong

Here's how I'll know if I'm wrong about Silicon One over the next 18 months:

Customer Adoption Metrics

Prove me right: Cisco announces meaningful external customer wins for Silicon One in AI deployments beyond the initial hyperscaler shipments—Fortune 500 companies building AI capabilities on 8000-series platforms. The October 8th Microsoft endorsement is a good start, but I need to see broader adoption.

Prove me wrong: Silicon One remains primarily deployed in Cisco's own infrastructure or limited to a handful of hyperscaler customers. External enterprise customers choose NVIDIA, Arista, or Broadcom-based alternatives. Market share in AI networking stays flat or declines.

Performance Benchmarks

Prove me right: MLPerf or similar benchmarks show Ethernet-based Silicon One deployments achieving 85-90% of InfiniBand performance for AI training workloads—close enough that operational advantages matter.

Prove me wrong: The performance gap stays at 60-70% or widens. "Good enough" isn't actually good enough for most AI use cases.

- WWT Blog: The Battle of AI Networking: Ethernet vs InfiniBand

- Cisco Blog: Uncompromised Ethernet: Performance and Benchmarking for AI/ML Fabric

Ultra Ethernet Consortium Progress

Prove me right: The consortium finalizes specifications for AI networking, and Silicon One is first to market with implementations. Standards-based Ethernet becomes the AI networking conversation.

Prove me wrong: The consortium fragments, progress stalls, or the specifications don't address InfiniBand's key advantages. Ethernet standardization takes too long and the market moves on.

Integration Delivery

Prove me right: The Networking Cloud, ThousandEyes, and Splunk integrations ship and actually work—unified visibility, unified management, unified troubleshooting for AI networking alongside traditional infrastructure.

Prove me wrong: The integrations remain vaporware or ship with limited functionality. Silicon One remains operationally siloed from the rest of Cisco's portfolio, undermining the "unified operations" value proposition.

Market Trajectory

Prove me right: By Amsterdam 2026, Cisco can point to enterprise customers running meaningful AI workloads on Silicon One, with concrete evidence that the operational simplicity story resonates. The "scale-across" positioning gains mindshare as a distinct category from hyperscale training.

Prove me wrong: By Amsterdam, the conversation is still "NVIDIA for training, maybe Arista for some edge cases, Cisco is trying but not relevant." Market share data confirms Cisco is losing the AI networking transition.

The Timeline: What I'm Watching Through Amsterdam and Beyond

Here's how I expect this to play out if the bull case is right—and what I'll be looking for at Cisco Live Amsterdam in February 2026:

By Amsterdam (February 2026): This is the critical milestone. I need to see three things:

- 1. Customer evidence beyond hyperscalers. The October announcement gave us Microsoft and initial hyperscaler shipments. By Amsterdam, I need to see enterprise customer deployments—even early stage. If Cisco can't show Fortune 500 companies building AI capabilities on Silicon One, the enterprise market thesis weakens.

- 2. Integration proof points. Unified management working in production. ThousandEyes showing AI traffic visibility. Splunk correlating network and application telemetry. If these remain disconnected, the operational advantage story falls apart.

- 3. Competitive positioning clarity. Cisco needs to double down on the message: "We're not trying to beat InfiniBand for hyperscale training. We're winning the enterprise AI networking market and the scale-across problem by making Ethernet good enough and operationally simpler." If the messaging is still "we compete with NVIDIA everywhere," they're losing.

First Half 2026: Cisco should be announcing meaningful wins with the 8223 and P200—enterprises building distributed AI infrastructure on top of existing Cisco networks. Not just proof-of-concept, but production deployments.

Second Half 2026: Performance benchmarks should show Ethernet-based Silicon One achieving 85%+ of InfiniBand performance for common AI workloads. "Good enough" needs to become defensible with data, not just positioning.

Through 2027: Ultra Ethernet Consortium specifications should be finalized, and Silicon One should be shipping implementations. If standards-based Ethernet isn't a credible alternative by then, the market will have moved on.

If we get to mid-2026 and these milestones haven't happened, I'm wrong. The historical pattern doesn't repeat, and Cisco missed the AI networking transition.

But if Cisco delivers on even two of the three Amsterdam proof points, the bull case stays alive. The October 8th announcement already validated one element faster than I expected. That's what I'm watching for.

Why I Think the Bull Case Holds

Here's why I'm making this argument despite the current numbers looking weak:

1. Cisco has won this exact game before. Three times. The pattern is consistent: invest in making Ethernet good enough, leverage operational simplicity and installed base, win the long game as the market fragments beyond the initial use case.

2. AI workloads are evolving faster than infrastructure. Today's training-focused deployments won't be tomorrow's dominant pattern. Inference, edge AI, smaller-scale fine-tuning, distributed workloads across multiple data centers—these favor Ethernet's operational advantages.

3. Enterprise buying patterns favor evolution over revolution. CIOs aren't ripping out their Cisco-based networks to deploy InfiniBand. They're looking for AI capabilities that integrate with existing infrastructure. Silicon One makes that evolution possible.

4. The technical performance gap is narrowing. Ultra Ethernet specifications, Silicon One's programmable architecture, and continued investment in Ethernet standards are closing the gap. "Good enough" is getting better.

5. The operational integration story is real. This isn't just marketing. Networking Cloud, ThousandEyes, Splunk—these are shipping products that create genuine operational advantages. If Cisco executes on integration, they're offering something competitors can't match.

6. The October 8th evidence validates execution. The P200 and 8223 shipped to hyperscalers faster than I expected. Microsoft endorsed it publicly. The specs address real constraints (power, scale-across connectivity). Cisco is executing, not just talking about executing.

But—and this is critical—all of this depends on continued execution. The historical pattern only matters if Cisco actually delivers on the integration promises, ships competitive silicon, and wins meaningful customer deployments beyond the initial hyperscaler wins.

That's what I'm watching for.

The Invitation

Here's where I need your help pressure-testing this thesis:

If you're deploying AI infrastructure: Are you choosing InfiniBand, Ethernet, or hybrid? What's driving that decision? Is operational simplicity actually a factor, or is it just marketing?

If you're evaluating Silicon One: What's working? What's half-baked? Where does the integration story break down?

If you think I'm wrong: Show me why. Is the historical pattern irrelevant this time? Is the performance gap too wide to close? Is Cisco's execution falling short? Does the October 8th announcement change your assessment, or is it too little, too late?

I'm making the bull case for Silicon One not because I know it's right, but because I think the market is underestimating Cisco's ability to execute their historical playbook one more time.

But I could be wrong. And I want to know before Amsterdam.

Up next: Hypershield and how eBPF-based distributed security might actually be the architectural shift Cisco claims—if the Isovalent integration delivers.

Your take? Am I overweighting the historical pattern? Is the AI networking transition fundamentally different from ATM/Token Ring/Fibre Channel? What am I missing about NVIDIA and Arista's advantages? Does the October 8th announcement strengthen or weaken the case? Let me know.

This is post two of an eight-part series building toward Cisco Live Amsterdam 2026. I'm making the bull case for Cisco's transformation and testing whether it holds up.

Next in the series: How Hypershield is reimagining security for AI-scale data centers—and why eBPF is the technology foundation that makes it credible.

About this series: I'm building toward Cisco Live Amsterdam in February by making sense of Cisco's biggest strategic moves. This is part learning exercise, part knowledge sharing. If something here resonates—or if you think I'm missing the mark—let's talk about it.